Project Overview

- This project is created with the intention to determine which factor(s) influences clients to apply and accept a personal loan from the bank.

- We found that an individual’s annual income and the number of family members are the most important factors in determining whether an individual accepts a personal loan from the bank.

- The dataset can be obtained from Kaggle.

- The libraries involved in the project include: Pandas, Matplotlib, Seaborn, and Plotly

- Link to this Project on Github

Objectives

What is the most influential factors to receiving a personal loan from the bank?

Data Cleaning and Organization

-

Some nominal variables are eliminated (such as “ID” and “Zip Code”).

-

No missing data is found.

-

Anomaly values, such as negative values in “Experience”, are replaced with the mean

-

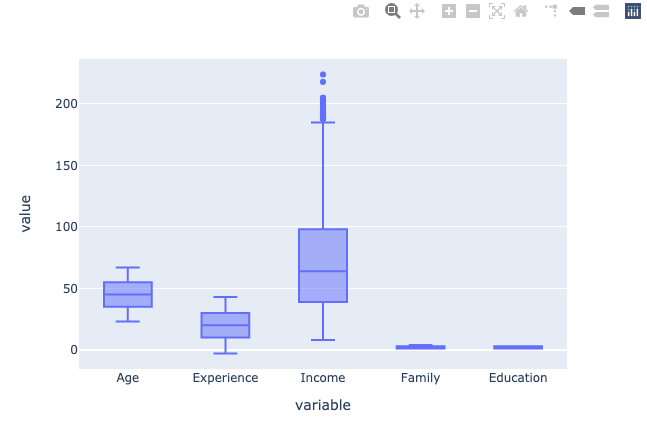

As depicted in the graph, there is a large number of outliers in “income”.

-

The correlation in the attributes is explored.

Analyzing The Data

-

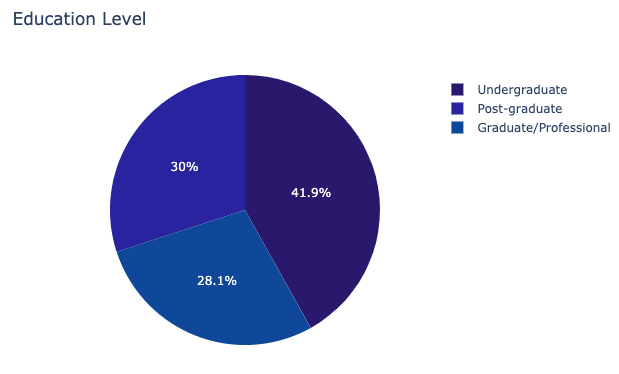

There are more people with an “undergraduate” degree, however, the distribution of educational level attained is relatively equivalent among the people who received a loan.

-

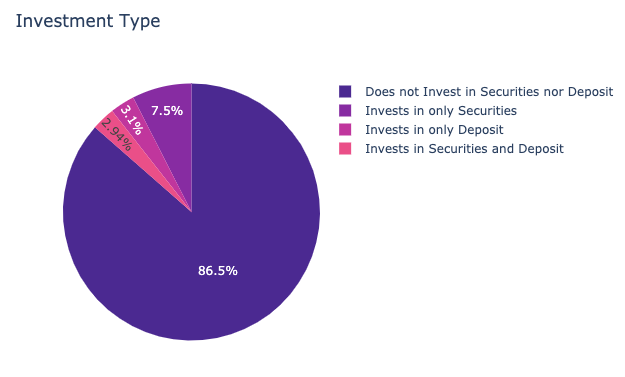

Most individuals who receive a personal loan do not hold or invest in any securities or bank deposits in their investment account

-

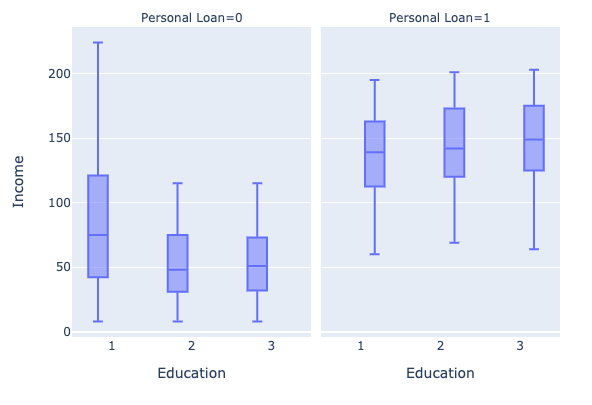

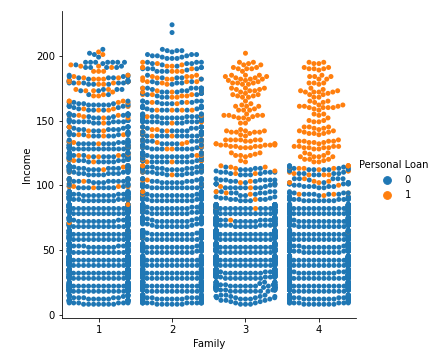

Most people with an higher income are approved for a personal loan from the bank.

-

Individuals who have family size 3 or greater with a higher income between 100k to 200k are more likely to apply for a loan.

Interpreting the Results

- “Income” and “number of family member” are positively correlated with personal loan.

- “Education level” and investments has the least influence or impact on whether an individual decides to accept the loan

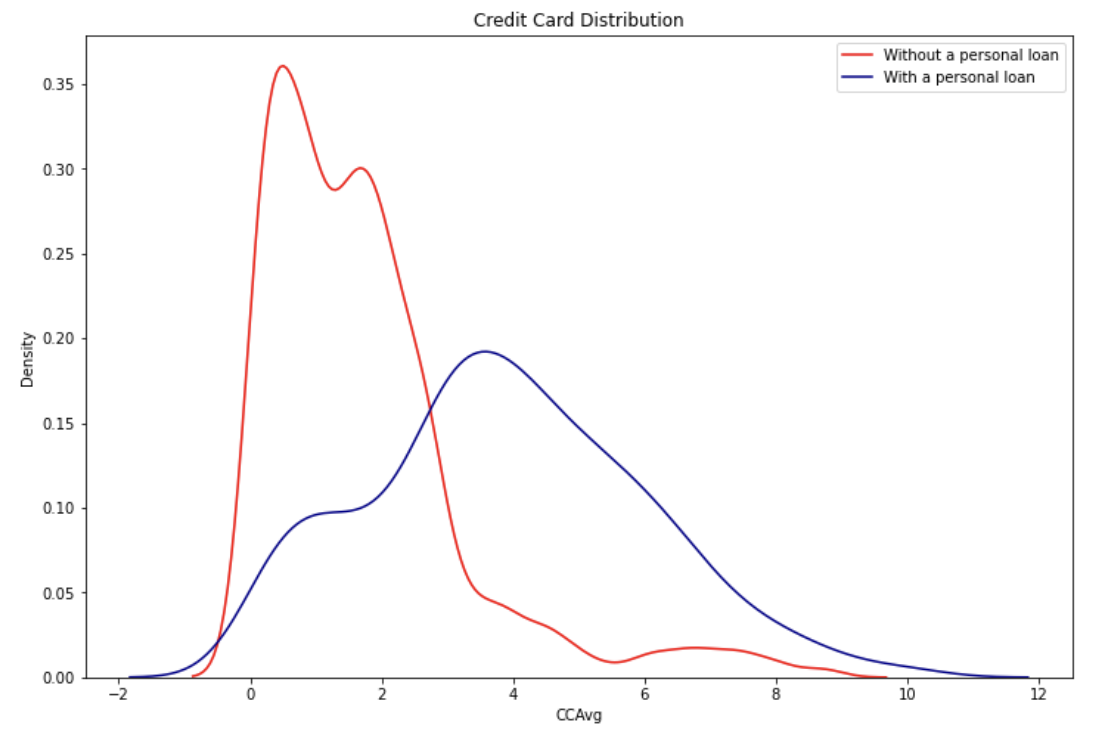

- Further investigation is recommended to determine the correlation between “income” and other factors such as “mortgage” or “CCAvg” etc.

- You can access the Jupyter notebook here.